georgia film tax credit 2021

Qualified education expense tax credit. BT has been approved to perform these audits for 2021.

Georgia Film Industry Leaders Believe Tax Incentives Are Crucial To Continued Success Atlanta Business Chronicle

Joining them now is an additional education-related tax credit this one assisting public schools.

. Beginning january 1 2021 mandatory film tax credit audits must be conducted before usage of the film tax credit. As of 112021 the following changes are now in effect. The following documentation provides information onreporting film tax credit and applying for a film.

The Georgia General Assembly enacted legislation HB 1037 requiring new mandatory film tax credit audits in Georgia. On average 1 of Georgia Film Tax credit can be purchased for 087 to 090. Unused credits carryover for five years.

Georgia offers multiple tax incentives for businesses and several for individuals. 159-1-1-01 Available Tax Credits for Film Video or Interactive Entertainment Production. Among the criticisms of the film tax credits in Georgia is that not enough of the states residents are working spending and paying income taxes in the state.

Georgia Tax Center Information Tax Credit Forms. Income Tax Credit Utilization Reports. Georgia Film Tax Credits were created to entice production companies to come to Georgia and spend their money on movies films commercials etc.

Georgia Tax Center Help Individual Income Taxes Register New Business Business Taxes Refunds Information for Tax Professionals. FAQ for General Business Credits. The Georgia loan out withholding rate is now tied to the Georgia corporate tax rate currently 575.

Third Party Bulk Filers add Access to a Withholding Film Tax Account. Tax credit audit via the Georgia Tax Center GTC. Statutorily Required Credit Report.

Register for a Withholding Film Tax Account. But Akins says more than 80 of his union members live in Georgia. Film Tax Credit Chapter 159-1-1 1 RULES OF THE GEORGIA DEPARTMENT OF ECONOMIC DEVELOPMENT CHAPTER 159-1-1.

The generating entity-the LLC-not the parent can elect to use the credit against its withholding account. 20-25 for all residents terms apply. The entity generating the tax credit the production company must have the projects certified for example the LLC.

There are three main benefits for purchasing Georgia Entertainment Credits. Loan out withholding rate. 159-1-1-03 Film Tax Credit Certification.

A Georgia taxpayer may purchase Georgia Entertainment Credits generally for around 88 per credit and apply them to their current year or future tax returns. Georgia doled out a record 12 billion in film and TV tax credits last year far surpassing the incentives offered by any. Film Tax Credit - Revised December 20 2021 CRED-2013-2-13.

The Massachusetts film tax credit which provides a 25 tax credit on production costs is scheduled to expire at the end of 2022. FILM TAX CREDIT. A Base Certification Application may be submitted within 90 days of the start of principal photography.

One reason many production companies select the state is because of the robust saving opportunities available through the Georgia Film Tax Credit. Qualified Education Expense Tax Credit. Film Tax Credit - Revised December 20 2021.

Film Tax Credit Bulletin 18205 KB Department of. The broadening of this legislation permits a Georgia corporate fiduciary or individual taxpayer to purchase these credits to offset their Georgia income tax liability. GEORGIA FILM TAX CREDIT For a project to be eligible for the 20 base transferable tax credit the Georgia Department of Economic Development must certify the project.

Some of the most popular ones available to individual filers are an education credit for private school scholarships and a film credit. Beginning January 1 2021 mandatory film tax credit audits must be conducted before usage of the film tax credit. The mandatory film tax credit audit is based on the date the production was first certified by.

The Georgia Department of Revenue GDOR offers a voluntary program. Income Tax Letter Rulings. Above and below-the-line residents get a 20 tax credit.

The way it works is that production companies get a 20 credit on what they spend for certain expenses while making their project. In fact according to the Georgia Department of Economic Development there was a new record set last year with 399 productions filmed representing a 29B infusion to the state economy. Productions that spend 50000 or more in the state meet eligibility requirements for a 25 tax credit.

Tax Credit and Rebate. How to File a Withholding Film Tax Return. Beginning January 1 2021 mandatory film tax credit audits must be conducted before usage of the film.

Claim Withholding reported on the G2-FP and the G2-FL. To earn the 20 film tax credit the Georgia Department of Economic Development must certify the project more on this later. The generating entity-the LLC-not the parent can sell or transfer the film tax credit to a Georgia taxpayer.

A further 5 can be granted if 1 million or more is spent in the state of Utah. TABLE OF CONTENTS. And if filmmakers spend more than 50000 on a production they will receive an additional 25 payroll tax credit.

Qualified projects distribution must extend outside the state of Georgia and have a minimum of 500000 qualified in-state expenditures over a. Getting a state tax deduction on Schedule A of your Form 1040 for the. Projects first certified by DECD on or after 1121 with.

One factor helping to create a workforce based in the state has been the Georgia Film Academy. Georgia film tax credits were created to entice production companies to come to georgia and spend their money on movies films commercials etc. The mandatory film tax credit audit is based on the date the production was first certified by the Department of Economic Development DECD and the credit amount according to the following schedule.

They get an additional 10 for providing that cool Georgia Peach logo at the end of the. Certification for live action projects will be through the Georgia Film Office. In 2020 Georgia passed The Georgia Entertainment Industry Investment Act HB 1037.

An audit is required prior to utilization or transfer of any earned Georgia film tax credit that exceeds 25 million in 2021 125 million in 2022 and for any credit amount thereafter. Income Tax Credit Policy Bulletins. Ensuring fulfillment of film tax credit back end requirements for approved projects Additional administrative duties such as phone and filing duties.

Georgia Department of Economic Development 75 Fifth Street NW Suite 1200 Atlanta Georgia 30308. Paying less on Georgia income tax. Audits are now required for productions certified in 2021 and claiming 25M in.

Instructions for Production Companies. How-To Directions for Film Tax Credit Withholding.

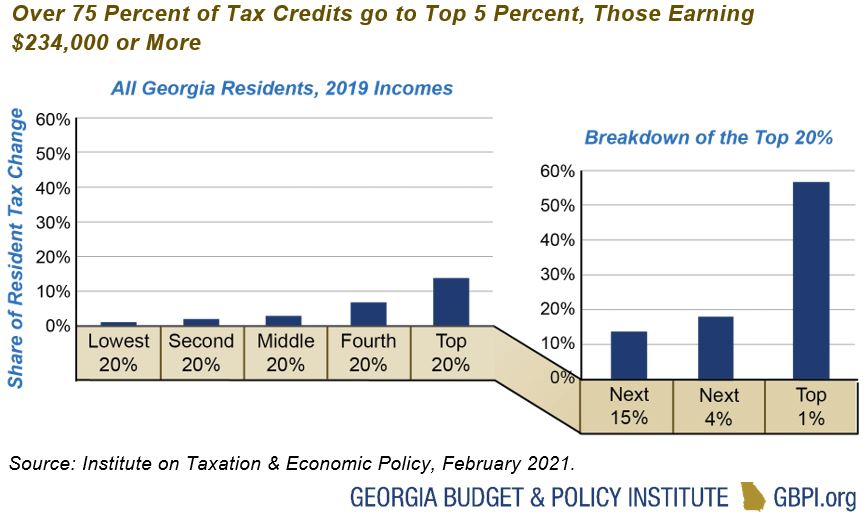

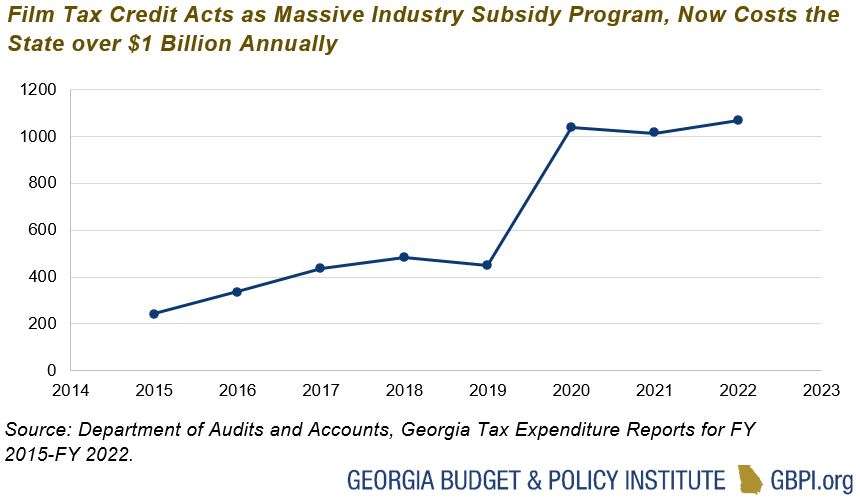

Georgia Tax Breaks Don T Deliver Georgia Budget And Policy Institute

What Christmas Means To Me Essay In 2021 Myself Essay Essay Love Essay

Lockdown A Testing Time For Couples Sayings City New Facebook Page

Simplified Tax Form Tax Forms Simplify Tax

Georgia Tax Breaks Don T Deliver Georgia Budget And Policy Institute

2021 Cartier Roadster Ballpoint Pen Green Wholesale Cartier Roadster Ballpoint Pens Ballpoint

Pin By Shirley Evans On Blue Georgia Georgia Georgia Law Tax Refund

Film Incentives State By State Breakdown 2021 Sethero

Gucci Proof On Mercari Creative Instagram Photo Ideas Creative Instagram Stories Instagram Life

Georgia S Film And Tv Tax Credit Hits Record 1 2 Billion In Reimbursements

Film Incentives And Applications Georgia Department Of Economic Development

Georgia S Film And Tv Tax Credit Hits Record 1 2 Billion In Reimbursements

El Abismo De Helm El Senor De Los Anillos Lord Of The Rings Helms Deep The Two Towers